skipped to

Departments

Volunteer Summit 2025

Learning Together. Leading Together. Thriving Together.

Bridgewater, Nova Scotia – November 8, 2025

Project Volunteer – an inter-municipal partnership bringing back the buzz in volunteering across Lunenburg and Queens Counties – is excited to bring you the first-ever Volunteer Summit, taking place Saturday, November 8, 2025, at NSCC Bridgewater. This one-day event will bring together 100 community volunteers from across Lunenburg/Queens counties for inspiration, skills-building, and connection.

Highlights include interactive workshops, an inspiring keynote, and practical sessions on recruiting volunteers, fundraising, grant writing, and more. Lunch, refreshments, and a welcome gift are included — plus a $500 prize to support one lucky organization (must be present to win).

Thanks to Municipal and Provincial government support, registration is just $15, with some subsidized spots available (please enquire at registration).

Register between October 1 and October 31.

Space is limited; to give more groups a chance to attend, please limit registration to two people per organization.

To register, select your breakout sessions from the details below, and call 902-275-3490 or email This email address is being protected from spambots. You need JavaScript enabled to view it.

A .pdf document of the table below can be found here: pdf Volunteer Summit Details(59 KB)

VOLUNTEER SUMMIT DETAILS 2025 |

|

Time |

Activity |

8:30 - 9:00 |

Registration & Networking |

9:00 - 9:15 |

Welcome |

9:15 - 10:00 |

Keynote Speaker: The Power of Local: Reigniting Volunteerism in Rural Communities with Max ChauvinIn rural Nova Scotia, volunteers remain the heartbeat of strong, connected communities. While the realities of volunteerism have shifted in the 2020s, the spirit behind it hasn’t changed. Max's keynote will celebrate the resilience and generosity of local volunteers, explore new trends and challenges, and highlight why the heart of community still lies in those who give their time, skills, and energy to make a difference. |

10:00 - 10:15 |

Coffee Break |

10:15 - 11:00 |

Summit Session #1: Don't Just Recruit Volunteers, Let's Build A Community! with Heather Killen, Volunteer Nova ScotiaWant to create a space where volunteers feel seen, supported, and motivated to stay? With a bit of planning and preparation, you can create a powerful network of passionate people who are truly invested in your mission. We'll dive into the latest trends in volunteering, both nationally and right here in Nova Scotia. We'll talk about who's volunteering, what motivates them, and how they prefer to give their time and skills. We'll show you how to shift your focus from simply filling spots to strategically planning for your volunteers. This means creating clear, compelling volunteer job descriptions, setting up an effective onboarding process, and providing the tools and support people need to succeed. When volunteers feel valued and prepared, they're more likely to feel a sense of ownership and purpose. |

11:10 - 12:15 |

Breakout #1: Please choose from 1 of the following four options (pre-registration is required)1. Grant Writing 101 - If you are new to writing grants, or have some experience and want some tips, this workshop is for you! Anna Haanstra, Regional Manager on the South Shore with the Province of NS, will share information on what to before searching for grants, where to find grants, tips and insight into how to submit a strong application and demystify some common questions about what makes a successful application. This session will include a presentation, discussion and list of local grant sources to take with you. 2. Community Halls Revitalization - Community Halls and other similar gathering spaces are a cornerstone of our rural communities. This presentation, with Andy Thompson and Meagan MacDonald from Aging Well Nova Scotia, will provide an overview of local transformation projects, before and after photos of community halls in rural Nova Scotia, an exploration of working collectively to source funding, and first-steps on community hall transformation in your area! 3. Fun-Fueled Fundraising: Turning Good Times into Great Results - When fundraising’s fun, everyone wins. Join Kristi McKee and Lisa Tanner from the Jennifer Collins Classic to discover creative ways to connect with your audience, make giving enjoyable, and maximize your funds raised. 4. Social Media and Basics of Marketing & Promotion - Kelly Duggan and Olivia Malley from Sport Nova Scotia will guide you through the fundamentals - like creating a marketing strategy, brand building, advertising, and leveraging digital and social media channels to build awareness of your organization in the community. |

12:15 - 1:15 |

Lunch |

1:15 - 2:20 |

Breakout #2: Please choose one of the following four options (pre-registration is required)1. Grant Writing 101 - If you are new to writing grants, or have some experience and want some tips, this workshop is for you! Anna Haanstra, Regional Manager on the South Shore with the Province of NS, will share information on what to do before searching for grants, where to find grants, tips, and insight into how to submit a strong application and demystify some common questions about what makes a successful application. This session will include a presentation, discussion, and list of local grant sources to take with you. 2. Uniting for Impact: Collaborative Strategies in Volunteering - This informative, interactive, and action-orientated session, brought to you by Louise Pomfrey-Talbot and Louise Hopper from Nova Scotia Health, will share insights about the factors that impact volunteering and participation in community. On their own, organizations may find it hard to tackle the challenges facing their communities. In this training, we will explore how working together can help us use our combined strength. Participants will learn practical ways to collaborate as volunteer organizations and work towards shared goals. 3. Bookkeeping for Non-Profits 101 - During this session, Cy Mayo from Belliveau Veinotte will discuss various topics for non-profit entities relating to day-to-day operations types of non-profits, accounting basics, governance responsibilities, and financial and tax reporting. Covering such things as:

4. Social Media and Basics of Marketing & Promotion - Kelly Duggan and Olivia Malley from Sport Nova Scotia will guide you through the fundamentals - like creating a marketing strategy, brand building, advertising, and leveraging digital and social media channels to build awareness of your organization in the community. |

2:30 - 3:40 |

Summit Session #2: Welcoming Newcomers: Engaging through Volunteerism with South Shore Multiculturism Society, YReach, and the Town of Bridgewater.This interactive workshop will help you gain insights into the benefits of involving newcomers, explore their unique challenges, and discover practical recruitment strategies. This session will feature first person newcomer narratives, multimedia presentations, small group brainstorming, and will provide you with the knowledge to facilitate strategic planning to attract newcomers to your organization. |

3:40 - 4:00 |

Closing, Door Prizes and Grand Prize |

Thanks to Municipal and Provincial government support, registration is just $15, with some subsidized spots available (please enquire at registration).

Register between October 1 and October 31.

Space is limited; to give more groups a chance to attend, please limit registration to two people per organization.

To Register, select your breakout sessions from the details above, and call 902-275-3490 or email This email address is being protected from spambots. You need JavaScript enabled to view it.

Winter Activities

- Rails to Trails Network

- MARC in Dayspring

- River Ridge Common in Pinehurst

- Miller Point Peace Park in Dayspring

- LaHave Sunset Park in Conquerall Bank

Water Recreation

LAKES:

- Wiles Lake Park in Wileville

- Molega Lake Park in Molega Lake

- Church Lake in Newburne

- Sucker Lake in Upper Northfield

- Mushamush Beach Park in Sweetland

OCEAN:

- United Communities Marine Park in Voglers Cove

- Sawpit Wharf Park in Garden Lots

- Hirtle’s Beach in Kingsburg

- Rose Bay Marine Park in Rose Bay

- Old Southeast Cove Wharf Day Park on Big Tancook Island

- Oakland Conservation Area in Oakland

RIVERS:

- LaHave Sunset Park in Conquerall Bank

- Miller Point Peace Park in Dayspring

- Petite Riviere Community Park in Petite Riviere

WATERFALLS:

- Indian Falls in Newburne

- Indian Brook Falls at River Ridge Common in Pinehurst

Play Parks, & Sports

- MARC Ballfields in Dayspring

- River Ridge Common in Pinehurst

Biking

- MARC in Dayspring

- River Ridge Common in Pinehurst

- Trails (multi use)

- Miller Point Peace Park in Dayspring

- Indian Point Rest Stop in Indian Point

Hiking / Walking

- Indian Path Common in Indian Path

- Indian Falls, Newburne

- MARC in Dayspring

- Miller Point Peace Park in Dayspring

- River Ridge Common in Pinehurst

- Arthur Young Trail in Cookville

- Gaff Point at Hirtles Beach in Kingsburg

- Trails (multi-use)

- Geocache Challenge

- District of Lunenburg Hike/Hike Nova Scotia Challenge

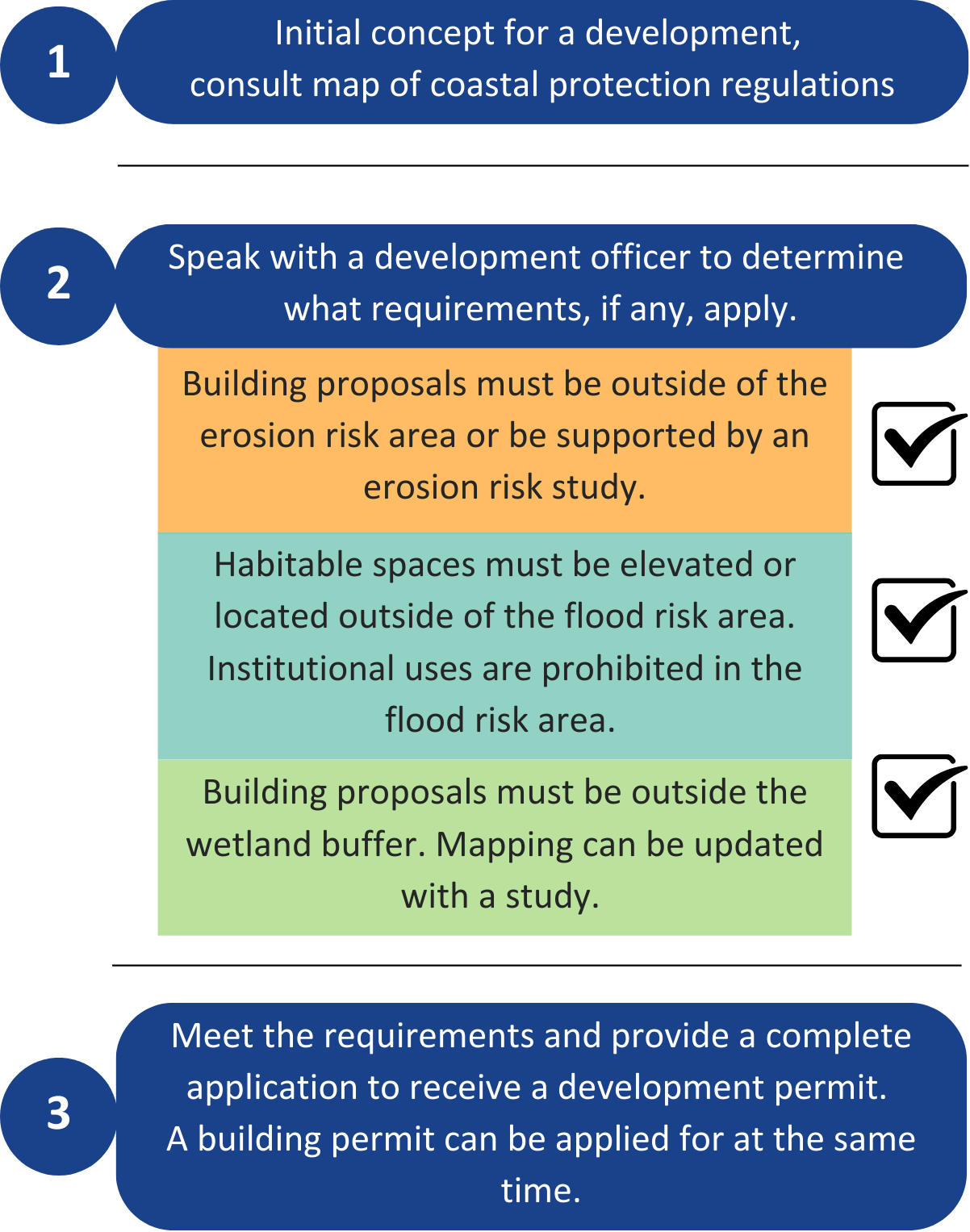

Coastal Protection

Coastal protection regulations are now in effect in the Municipality of the District of Lunenburg. On June 18, 2024, Council passed the Second Reading to amend MODL’s Municipal Planning Strategy and introduce a new Municipal-Wide Land Use By-law that includes coastal protection regulations. These changes were approved by the Minister of Municipal Affairs and Housing on August 9, 2024. The regulations aim to protect coastal development from the effects of climate change and to protect the coastline from human development by addressing concerns such as coastal erosion, flooding, and the preservation of sensitive ecosystems.

If a development is proposed within the Designated Coastal Protection Area (see the Coastal Development Permit Area on the Zoning Map), it is subject to the regulations of the Municipal-Wide Land Use By-law.

pdf Municipal Planning Strategy & Maps(5.29 MB)

pdf Municipal Wide LUB & Maps(2.72 MB)

Coastal Protection Regulations Summary

The Land Use By-law primarily identifies development setbacks that are tied to different areas within the Designated Coastal Protection Area.

Erosion Risk Area: The Coastal Erosion Risk Area is designed to protect properties from erosion and preserve ecosystems. Development cannot occur within 30 m from the top of the bank or the ordinary high watermark if the bank is indiscernible. No natural vegetation may be removed within 15m from the top of the bank or the ordinary high watermark.

Flood Risk Area: The Flood Risk Area identifies coastal regions most vulnerable to flooding from tides, sea level rise, and storm surge, projecting total inundation by 2100. No buildings in these areas can have habitable spaces below 3.97m of CGVD 2013. Institutional uses are strictly prohibited within the Coastal Flood Risk Area, regardless of elevation.

Wetlands: Development within 30 metres of Coastal Wetlands is prohibited.

Looking to develop or renovate near the Coast? Take a look at the flow chart below to understand potential next steps:

For more information about how the regulations came to be, please visit Engage MODL.

Coastal Erosion Risk Factor Assessment (CERFA)

Section 4.14.1 of the Land Use By-law requires a 30-metre horizontal setback from the top of the bank for new development. However, Section 4.14.5 of the Land Use By-law allows for a reduction in the setback, down to a minimum of 15 metres, only if a Coastal Erosion Risk Factor Assessment (CERFA) demonstrates that the erosion rate is slower than the planning horizon of 77 years.

The Municipal Guidelines document provides an overview of what must be included when submitting a CERFA to the municipality. The Technical Background and Guidance document is the full report.

CERFA Technical Background and Guidance

What is Planning?

Planning is the act of managing land uses in the present and into the future to help shape sustainable, equitable, and innovative communities. In a municipality, land use is guided by planning strategies and by-laws.

Municipal Planning Strategy

A municipal planning strategy guides the development and management of a Municipality. The municipal planning strategy has the long-term vision of community, sets the guiding principles on a variety of sectors, and is written in general terms. To further this purpose, the municipal planning strategy establishes:

1. policies which address problems and opportunities concerning the land development and the effects of the development;

2. policies to provide a framework for the environmental, social, and economic development within the Municipality;

3. policies that are consistent with the provincial interest on drinking water protection, agricultural land conservation, flood risk mitigation, infrastructure management, and housing promotion; and

4. specify actions necessary for implementing the municipal planning strategy.

Secondary Planning Strategy

Secondary planning strategies are supplementary to a municipal planning strategy and pertain to a specific community or topic within a municipality.

Land Use By-law

A land use by-law expands on the policy statements in a planning strategy. It is written in more detail and definitive terms so there is a clear understanding of what you can and cannot do with your lands. Land use by-laws typically identify zones that encourage certain land uses (e.g., residential, commercial, etc.). By-laws state one or more of the following for each zone:

- Lot area and frontage requirements;

- The location, size, and height of structures;

- Permitted signage, outdoor storage, parking;

- Erosion control standards such as setback from watercourses.

Tax Installment Prepayment Plan Enrollment Form

Tax Installment Prepayment Plan (TIPP) - Change or Cancel TIPP Request Form

More Articles ...

- PRO Fund

- MODL Carbon Emissions Calculator

- Research and Innovation

- Community Engagement

- Sustainable Land Use Planning and Development

- Natural Environment Protection and Conservation

- Community Solar Garden

- Waste Reduction, Recycling, and Composting

- Low Carbon Transportation

- Energy Efficient Homes and Buildings

- Community Climate Action

- Electrification of Municipal Fleet